The Misery Index: How is Eastern Europe Performing?

In Globe Asia Steve H. Hanke published this month an essay about the misery index which I liked very much. Consequently, I wanted to share some of his results with the “index aficionados” in our network, and this is my short summary.

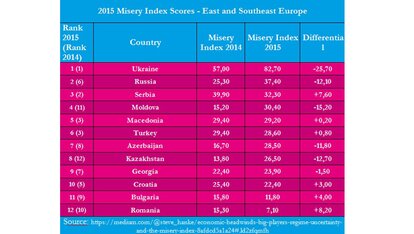

The misery index is defined as the sum of the unemployment, inflation and bank lending rates minus the percentage change in real GDP per capita. The top countries in this index are the most miserable. Mr. Hanke’s data are from the Economist Intelligence Unit and he presents the results according to region. Of the 22 countries of our East and Southeast Europe region only 12 are mentioned in the above index (for Mr. Hanke, 9 of which are situated in Europe and 4 in Asia).

Mr Hanke produces what he calls a “rogue’s gallery”, countries with a misery index of 40 or above, consisting of Venezuela, Brazil, Argentina, Ukraine and South Africa. Furthermore, the author thinks that countries with a score above 20 are “ripe for reform”. This applies to 10 of the 12 countries from our region: Ukraine, Russia, Serbia, Moldova, Macedonia, Turkey, Azerbaijan, Georgia and Croatia. Only Bulgaria and Romania show a better performance in this index with 11.8. and 7.1. respectively. This, however, does not mean that the two countries would not benefit from economic reforms. Of the other EU member states, only Greece and Spain show a similarly devastating performance in 2015 (with 29.0 and 25.8 points respectively). Interesting is also the fact that neither Germany nor the Netherlands are the countries with the lowest misery index. Rather, unexpectedly for me, it is Hungary (5.2 points).

Which countries were the best improvers from 2014 to 2015? Here Romania (+8.2) is leading the pack followed by Serbia (+7.6), Bulgaria (+4.0) and Croatia (+3.0). The performance worsened the most in Ukraine (-25.7), Russia (-15.2) and Kazakhstan (-12.7). These are the countries where the populations suffer most under the unstable macro-economic climate. From an ordo-liberal perspective competition, the enforcement of contracts and the security of property rights matter most. But SOE’s and distortions by powerful vested interests from oligarchs prevent competition from unleashing its healthy effects. I suspect that the independence of central banks must also be compromised somehow in some of the worst performing countries. These are golden times for economic reformers. If politicians would let them do their jobs, many countries in Eastern Europe would be much better off. The people would deserve this.

Dr Rainer Adam

Regional Director FNF East and Southeast Europe