Alumni Voices

Pakistan’s Budget 2024-25: Promises to Policies

Introduction

In the grand theatre of fiscal policy, Pakistan’s Budget 2024-25 took centre stage in the sizzling heat of June, promising a blockbuster performance. With ambitious tax targets and a plot twist involving the International Monetary Fund (IMF), this year’s budget presentation was nothing short of a high-stakes drama. But behind the curtain, the reality is a mix of economic strategies and fiscal manoeuvres that aim to steer the country through turbulent economic waters.

As the Finance Minister of Pakistan unveiled the script, the audience - comprising economists, policymakers, and the general public - waited with bated breath. Will the budget be the hero that saves the day, or will it reveal itself as a complex narrative with more questions than answers? Let us do a deep dive, examining its key components, expected impacts, and broader economic implications, while also highlighting positive aspects and potential benefits. Additionally, can insights from behavioural economics improve budget making? How do our neighbours fare in this yearly genre?

Budget Overview and Fiscal Measures

The Finance Bill 2024-25, presented by Pakistan’s coalition government, aims to tackle the country’s fiscal challenges head-on. Key fiscal measures include:

- Tax Policy Changes: Proposes significant increases in both direct and indirect taxes, with direct taxes expected to rise by 48% and indirect taxes by 35%. Measures include the withdrawal of tax exemptions, higher corporate taxes for exporters, and increased personal income tax rates.

- Expenditure Adjustments: Outlines a 21% year-on-year rise in current expenditure, with debt servicing accounting for 50% of this increase. Despite significant cuts in previous years, development spending is set to increase by 50%, highlighting a commitment to infrastructure and public sector projects.

- Ambitious Targets: Sets an ambitious tax revenue target of PKR 13 trillion, a nearly 40% increase from the previous year, aiming to reduce the fiscal deficit to 5.9% of GDP from 7.4%.

What’s Good?

The increase in Public Sector Development Program (PSDP) spending reflects a commitment to infrastructure development and includes investments in transportation, energy and social infrastructure projects. The ambitious tax revenue target and measures to increase tax compliance demonstrate a strong focus on enhancing the government’s revenue base essential for fiscal stability. Increased salaries and minimum wage will also provide some relief to an inflation-weary public. Certain measures, such as tax exemptions for small businesses and incentives for the agriculture sector as well as funds for promoting exports, attracting FDI, and supporting IT sector, aim to support key sectors of the economy and promote inclusive growth. Then there are proposed reforms in the energy sector, including rationalisation of tariffs and reduction of subsidies - steps toward addressing structural inefficiencies and reducing the fiscal burden of circular debt.

What’s Bad?

One is confronted by a stark picture: a country where only 5 million out of 240 million individuals contribute direct taxes. This microscopic tax base does not merely reflect administrative inefficiency or policy oversight; it epitomises a systemic crisis that, if unaddressed, threatens the economic stability of the nation. The government, rather than widening the net to encapsulate a broader segment of the population, is once again resorting to extracting more from those already within the tax loop. This approach not only exacerbates the burden on a sliver of the populace but also stifles potential economic vibrancy by discouraging higher earnings and capital investment.

Pakistan: a country where only 5 million out of 240 million individuals contribute direct taxes. This microscopic tax base does not merely reflect administrative inefficiency or policy oversight; it epitomises a systemic crisis.

Pakistan’s tax collection woes stem from a confluence of systemic issues that cripple its fiscal framework. The absence of a clear, consistent tax policy leads to reliance on ad-hoc measures, making strategic tax planning nearly impossible for both businesses and the government. This problem is exacerbated by a proliferation of confusing and ever-expanding exemptions and rates, coupled with arbitrary revisions that further complicate compliance. As a result, the cost of complying with tax regulations is prohibitively high, pushing many businesses to forego formal registration in favour of cheaper individual rates. Plus, taxpayers who are subject to presumptive taxation often avoid voluntary payment, perpetuating a cycle of low compliance. The tax base remains alarmingly narrow, riddled with evasion and sectors like agriculture that are under-taxed or exempt. Moreover, a dysfunctional refund system discourages honest reporting and timely payment, as taxpayers have little faith in being reimbursed for overpayments.

Reliance on indirect taxes, historically the mainstay of its tax collection, presents a regressive fiscal system where the burden falls uniformly on all consumers, regardless of income level. This broad targeting exacerbates inflationary pressures as the costs of goods and services increase. Although simpler to administer and collect, they come with significant drawbacks that impede economic openness and growth.

- Customs duties in Pakistan are notably problematic, characterised by an anti-export bias that effectively closes off the economy. These duties are approximately nine times higher than the global average, creating a significant barrier to international trade and stifling export growth.

- Meanwhile, the General Sales Tax (GST) suffers from weak enforcement, with major gaps in the registration of supply chains. This disjointed system taxes goods and services separately and is riddled with exemptions, leading to widespread inefficiencies and lost revenue.

- Furthermore, the absence of tax credits for imported goods that could enhance export capabilities - such as industrial machinery and inputs - undermines efforts to stimulate economic growth through international trade. This oversight in tax policy not only discourages investment in sectors critical for export expansion but also limits Pakistan’s ability to compete on a global scale.

Together, these factors create a fragile tax system that undermines economic stability and equitable development.

On top of this, despite needing an annual growth rate of 8% to absorb the burgeoning youth labour force, Pakistan’s economy shrank by 0.3% in 2022. Although there was a slight recovery to 2.3% growth in 2023, this was largely buoyed by an exceptional agricultural yield, rather than any substantive economic reforms or industrial expansion.

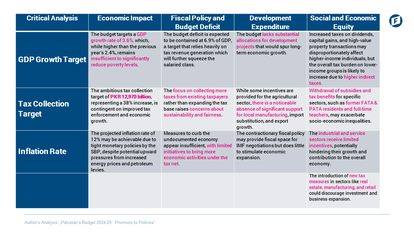

Budget 2024-25 , issues and missed opportunities.

© Friedrich Naumann Foundation for Freedom - Pakistan | Visulization by Rebea FirdousThe Provincial Fiscal High Wire

Setting high expectations on the provincial governments is another risky gambit, predicting a combined cash surplus of Rs 1200 billion to reduce the consolidated budget deficit by 1% of GDP. With Punjab targeting a Rs 650 billion surplus and Sindh bucking expectations by planning no surplus at all, this year’s fiscal projections seem tenuous at best. The strain of lofty targets means a revised ‘fiscal pact’ with the provinces, especially when the budget’s clear aim is to appease the IMF, with aggressive targets for revenue increases. As has happened before, analysts are already whispering there will be sequels to this movie - multiple mini budgets.

Economic Impacts and Market Reactions

In the wake of the budget announcement, the immediate ramifications for the Pakistani Rupee (PKR) and overall market sentiment were thrust under the microscope. The Finance Minister’s declaration of confidence in securing an IMF agreement by July catalysed a flurry of market activities, with exporters showing a keen interest in selling short-term forwards. This led to a modest dip in forward premiums, while the spot market found some footing amidst the fiscal tumult. Yet, the budget laid bare a glaring $20 billion financing gap, including $18 billion due in foreign loan repayments and $2.5 billion in short-term credits. This stark financial shortfall accentuates the critical need for IMF support and external funding to anchor Pakistan’s fiscal stability in turbulent waters.

Turning to inflation and interest rates, the government’s budget sketches a dual narrative of ambition and realism: it targets a GDP growth rate of 3.6% alongside an inflation forecast of 12%. The proposed revenue targets and escalated expenditures, particularly in debt servicing, paint a decidedly inflationary scenario. Should global oil and commodity prices hold steady, the 12% inflation target appears within reach. However, this fiscal framework suggests that an average interest rate of 15-16% for FY 2024-25 is prudent, with a potential easing to 10-11% by the close of June 2025.

Implications on Industries and Consumers

The budget also indicated plans to overhaul the current tax structure by eliminating zero ratings, exemptions, and reduced rates that have long burdened government revenue and impeded socio-economic development. This proposed recalibration in the tax regime involves shifting many items previously under favourable tax conditions to a standard rate of 17%, while a select few may transition to reduced rates. The reclassification will affect a wide range of goods and services. For instance, items like pharmaceuticals, agricultural produce, and educational materials such as books and newspapers, which were previously exempt, will now be taxed, leading to price increases that will affect hospitals, food production, and education costs. Similarly, zero-rated industries, including key export sectors like textiles and office stationery, will face higher costs, potentially eroding their competitive edge internationally. Reduced tax rates currently benefiting sectors involved in local imports and exports, as well as certain manufacturing processes, will be withdrawn, escalating costs across industries and leading to price hikes in consumer goods ranging from processed foods to capital equipment. The broad application of a uniform 17% tax rate across various services - including banking, construction, and telecommunications - will standardise tax obligations but also increase operational costs that are expected to ripple through the economy, affecting both businesses and consumers alike.

Debt Sustainability and Long-Term Challenges

In Pakistan, public debt has reached an alarming PKR 67.5 trillion, with domestic obligations, spurred by high interest rates, posing a significant challenge. This debt crisis, exacerbated by the government’s heavy reliance on domestic banks for financing, not only introduces systemic risks to the financial sector but also stifles private sector growth by crowding out credit.

To steer out of this fiscal quagmire, an old drum needs to be beaten again - urgent, Structural Reforms, a Debt Management Strategy and Data-Driven Monetary Policy. And of course, taking the bull of Non-Critical Governmental Functions/Expenditure by the horn! Streamlining government operations by shutting down redundant agencies/departments; limiting funding for new projects under the PSDP until previous ones are completed; and adopting a results-based approach to public spending. While privatizing state-owned entities and cutting subsidies offer temporary reprieve, enduring stability will depend on such changes aimed at enhancing productivity and curtailing wastage.

Highlighting how tax revenues directly fund local infrastructure projects or social programs can enhance public buy-in.

Is there a Silver Lining?

Behavioural economics can provide valuable insights to improve budget-making by addressing how people actually behave rather than how they are expected to behave. Some principles include:

- Nudge Theory: Small interventions or ‘nudges’ can help steer people towards more desirable behaviours without restricting freedom of choice. For example, simplifying tax forms and offering incentives for timely tax payments can improve compliance.

- Loss Aversion: People tend to prefer avoiding losses over acquiring equivalent gains. Framing tax payments as a way to avoid future penalties or losses can increase compliance rates.

- Salience: Making the benefits of budgetary allocations more transparent and salient to the public can garner broader support. Highlighting how tax revenues directly fund local infrastructure projects or social programs can enhance public buy-in.

- Default Options: Setting beneficial defaults can improve outcomes. For instance, automatically enroling eligible citizens in social welfare programs unless they opt-out can increase participation and support.

What Can Pakistan Learn from its Neighbours?

Much like the premiere of a Pakistani film, the annual budget presentation in each South Asian country draws crowds and sets the stage for a season of economic narratives that unfold with suspense and scrutiny.

- In India, the budget presentation transcends mere fiscal planning; it becomes a national spectacle. Here, the Finance Minister’s speech is not just a dry enumeration of numbers but a declaration of policy intent, scrutinised by everyone from policymakers to the people on the street. Extensive media coverage amplifies its reach, sparking discussions that penetrate every layer of society. The Lok Sabha transforms into an arena of fiery debate, which often ignites, reflecting the sometimes volatile nature of fiscal discourse.

- Moving east to Bangladesh, the budget presentation mirrors this significant public engagement, though with local nuances. The Finance Minister’s comprehensive review sets the stage for intense parliamentary debates and public discourse. The discussions not only dissect the fiscal measures but also their broader economic implications. Public reactions often blend hopeful optimism with cautious scepticism, reflecting concerns about the practicality of economic targets and their impact on various sectors.

- In contrast, Sri Lanka’s budget presentation, while thorough, is marked by a more subdued tenor. The event is formal, detailed, yet lacks the dramatic flair seen in its larger neighbours. Despite this, the budget does not fail to attract keen interest from the media and the public.

While each country in the region showcases distinct traits during their budget presentations, common threads weave through them: the importance of transparency, the necessity for detailed documentation, and the crucial role of stakeholder engagement. These elements are essential for crafting budgets that not only promise fiscal stability but also strive to meet the socio-economic aspirations of their populations. Whether in India, Bangladesh, or Sri Lanka, the annual budget reflects a complex interplay of economic forecasting, political ambition, and public expectation, underscoring the shared challenges and goals across the region. We have much to learn from our neighbours.

Conclusion

Pakistan’s Budget 2024-25 aims to address immediate fiscal challenges and secure IMF support, but its ambitious targets and reliance on increased taxation raise questions about feasibility and socio-economic equity. The budget’s focus on meeting IMF conditions may provide short-term stability, but achieving long-term economic growth and stability requires substantial structural reforms. Effective implementation, political stability, and a balanced approach to fiscal consolidation and economic growth are essential for Pakistan to address its current economic challenges and move towards a sustainable and inclusive economic future.

While the budget includes commendable measures to boost development spending and support vulnerable sectors, it must be complemented by robust efforts to reduce inequalities and foster a more resilient and dynamic economy. The path forward will demand significant political will, strategic planning, and collaborative efforts to ensure that the potential benefits of the budget are fully realised. Insights from behavioural economics can enhance budget-making by aligning policies with actual human behaviour, thereby improving compliance and support. Comparing budget presentations with neighbouring countries highlights the importance of transparency and stakeholder engagement in achieving successful fiscal outcomes.

- 'Alumni Voices' is a series of articles written by Pakistani professionals from different walks of life on their perspective on current affairs of the country. The views expressed in this article do not necessarily represent the views of the Friedrich Naumann Foundation for Freedom.